Today, more than ever (in America), we find ourselves in a perfect storm of product and services availability, marketing efforts and technology (drone package delivery, anyone?). Pay with a swipe, pay with a tap, send money with a pop. It is so, so easy to get “what we want” and get it now. But how is this changing us as a society?

In our great grandparents’ time, a traditional buying scenario went like this: The whole family awaits the arrival of the Sears catalog. This huge volume contains clothes for Mom, tools and tractors for Dad, and even toys for the kids. Pouring over it’s pages, the family chooses what they need and want, figure out what everything will cost, then out comes the cookie jar. This family lived in a time before TV, bombarding them with ads. No quick cash from an ATM, no “tap that app” cell phones. But every time money came into that home, some of it was put into the cookie jar. When they had enough funds in there for the highest priority items (tractor parts, some clothes), they pulled the trigger and ordered it from Sears, paying cash. There were no credit cards.

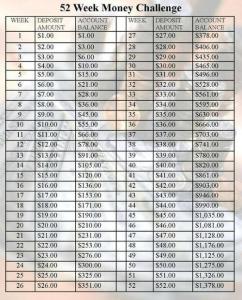

This family used the Sinking Fund technique, and never bought anything except perhaps their house and land on credit. They have had late nights worrying about their crop yields, but they never stressed about credit card payments, or why they suddenly had so much stuff that they had to rent a storage unit to hold it all.

Now, we live in a different world. Better medicine, longer lives, sure. But is our love of stuff and the ability to get it NOW a good thing? Recently, I traveled to Las Vegas for a convention. Not a gambler, but people watching? Oh, my, what a show. Weekend evenings, packs of young things, both ladies and men, could be seen pack hunting. But what made me really stop and think about our get it now mentality was a shop in the downstairs area of the MGM Grand.

For a lot of folks, Vegas weekends are legendary. Full of laughter and liquor. Laughter has no negative aftereffects but booze? Too much of this stuff, and your day starts out tomorrow later and slower. But this is Vegas, baby, you can have your cake and eat it too (as long as you pay for it, of course). In that basement was a clinic. A clinic where anyone can stumble in, get placed on a comfy couch and have a licensed medical technician pierce your skin with an IV needle and pump you full of the things you need. Need a pick-me up? Come on in! Hungover, but want to get back in the swing now? Come on in! This clinic (and another mobile ‘clinic’ we saw roaming the streets on the strip) were nothing short of awe inspiring.

So now in Vegas, your body no longer has to pay the full price for a night of partying. Your wallet will be lighter (hey, it’s Vegas, right), but if you tie one on Friday night, by early Saturday afternoon, you can feel as right as rain, ready to repeat the process. Just wear long sleeve shirts to work after you come back so your coworkers and bosses won’t wonder about the needle marks on your arm.

Get it all, get it now. Today’s American life is built with treats as sweet as sugar, isn’t it? Only $14.95 a month? Sure! But would you reconsider if the same product ran you $180 every year? That’s what $14.95 a month does to your net worth, but do you see it for what it is as it drips money out of your account? Easy payments! Just like candy, it gets you the sweet treat you want NOW, but oh the cavities later.

Cavities like lower retirement account balances. Too much stuff, cluttering up your house and life. Or maybe it’s hard to manage debt. Our “get it all and get it now” outlook is going to cost us BIG TIME in the long run.

Try to take a Sears catalog outlook on your spending. Plan ahead, save for yourself first (403b, 401k, IRA) and only buy things that you really need or want (and be super careful with those wants, right), and save up your money until you can pull the trigger on the items. Change your outlook from the Get It Now, and you and your family can have a bright financial future.

Sorry to post this so close to Christmas, but this one has been boiling away for awhile. Merry Christmas!